Arbitrage is a cornerstone of sophisticated financial trading, allowing investors to profit from inefficiencies across various markets. Though the opportunities for arbitrage are typically fleeting, their execution—when done effectively—can yield significant gains. This blog delves into the nuances of arbitrage, exploring its foundational principles, three prominent strategies, and the role it plays in modern financial markets.

What Is Arbitrage?

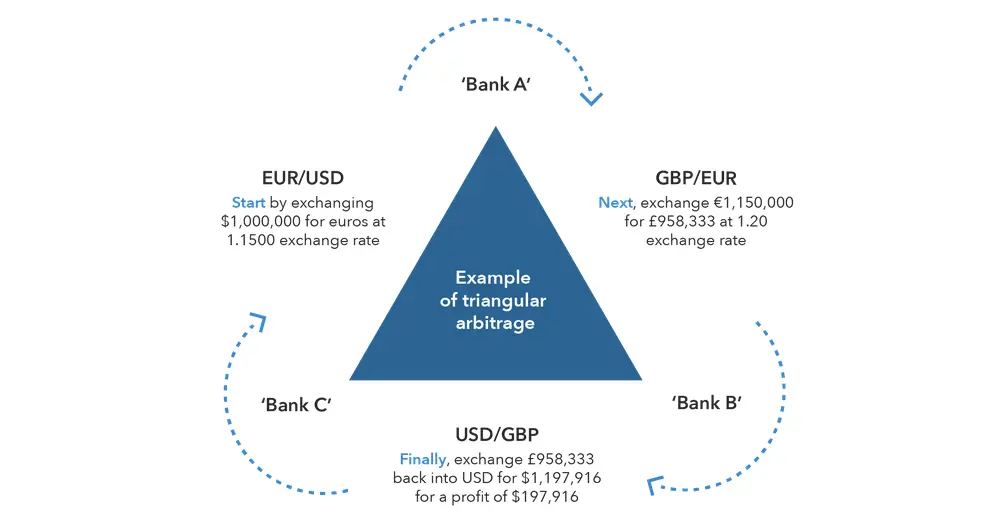

Arbitrage is the simultaneous purchase and sale of an asset across different markets to exploit price discrepancies. These discrepancies, while often minimal, offer opportunities for quick, risk-free profits. Arbitrage transactions are a hallmark of market inefficiencies and are most effective in highly liquid markets such as:

- Stocks

- Commodities

- Currencies

Key Characteristics of Arbitrage:

- Market Inefficiencies: Arbitrage relies on slight mispricings between markets.

- Speed: Opportunities typically last only seconds or minutes, requiring rapid action.

- Volume: To make arbitrage lucrative, traders often deal in large quantities of the asset.

Modern technology, including sophisticated algorithms and high-frequency trading systems, has made arbitrage more competitive, reducing the window of opportunity for manual traders.

Who Conducts Arbitrage and How?

Arbitrage is primarily conducted by large financial institutions, hedge funds, proprietary trading firms, and, to a lesser extent, individual investors. Here's how different players engage in arbitrage:

1. Institutional Players:

- Hedge Funds: Use arbitrage as a core strategy to generate consistent returns.

- Proprietary Trading Firms: Employ advanced algorithms and trading systems to exploit microsecond opportunities.

- Banks: Often engage in forex arbitrage and exploit interest rate differentials.

2. Individual Traders:

- Retail traders can participate in arbitrage, but their effectiveness is limited by high transaction costs, latency, and lack of access to sophisticated tools.

- Popular platforms such as crypto exchanges occasionally present arbitrage opportunities due to market fragmentation.

Tools and Technologies for Arbitrage:

To execute arbitrage effectively, traders utilize specialized technologies:

- High-Frequency Trading (HFT): Leveraging algorithms that execute thousands of trades per second, HFT systems identify and act on arbitrage opportunities faster than human traders.

- FPGA (Field-Programmable Gate Array): Customized hardware used in trading to minimize latency and maximize execution speed. FPGAs can process trading data in nanoseconds, making them indispensable for high-speed strategies.

- Low-Latency Networks: Direct market access through high-speed internet connections or colocated servers ensures minimal delays.

- Automated Trading Platforms: Software systems that identify arbitrage opportunities and execute trades with minimal human intervention.

Real-Time Data and Monitoring:

- Arbitrageurs require constant access to real-time market data, often from multiple sources.

- Advanced analytics and machine learning tools help identify and predict arbitrage opportunities.

Key Arbitrage Strategies

There are various types of arbitrage strategies, each tailored to specific market conditions and asset classes. Here, we discuss three widely recognized strategies:

1. Pure Arbitrage

Pure arbitrage involves buying and selling the same asset in different markets simultaneously to profit from price differences.

Example:

Imagine a multinational company’s stock trades at $100 on the New York Stock Exchange (NYSE) and $101 on the London Stock Exchange (LSE). By purchasing the stock on NYSE and selling it on LSE, a trader earns $1 per share minus transaction costs.

Characteristics:

- Common in foreign exchange and commodity markets.

- Requires sophisticated tools to identify opportunities quickly.

- Increasingly rare due to advancements in trading technology.

2. Merger Arbitrage

Also known as risk arbitrage, this strategy capitalizes on pricing differences before a merger or acquisition is finalized.

How It Works:

- An acquiring company announces plans to buy a target company at a premium to the target’s current stock price.

- Traders buy shares of the target company, anticipating profits once the deal closes.

- Alternatively, traders might short-sell if they expect the deal to fail.

Risks:

- Regulatory challenges may prevent the merger.

- Market conditions could deteriorate, affecting valuations.

3. Convertible Arbitrage

This strategy involves trading convertible bonds, which are debt instruments that can be converted into equity at a later date. Traders exploit price differences between the bond and the underlying stock.

Example:

- Scenario 1: If the bond is undervalued, traders go long on the bond and short on the stock.

- Scenario 2: If the bond is overvalued, traders go short on the bond and long on the stock.

Benefits:

- Offers diversified risk profiles through exposure to both equity and fixed income.

Advanced Arbitrage: High-Frequency Trading and FPGA Technology

High-frequency trading (HFT) and FPGA technology have revolutionized arbitrage by making it faster and more efficient:

High-Frequency Trading (HFT):

- HFT firms execute trades at lightning speed using algorithms.

- Trades are often completed in milliseconds, exploiting fleeting price discrepancies.

- Requires colocated servers near stock exchanges for minimal latency.

FPGA Technology:

- What is FPGA?: Field-Programmable Gate Arrays are customizable hardware circuits optimized for high-speed processing.

- How it Helps: FPGA-based systems process large volumes of market data in nanoseconds, providing a critical edge in competitive markets.

- Applications in Arbitrage: Used for tasks such as order matching, price discrepancy detection, and automated trade execution.

Challenges in Arbitrage

Despite its potential, arbitrage is not without risks and limitations:

- Transaction Costs: High fees can erode profits.

- Execution Speed: Opportunities may disappear in milliseconds.

- Regulatory Risks: Cross-border transactions may face legal hurdles.

- Market Access: Individual investors often lack the tools or capital to compete with institutional players.

Conclusion

Arbitrage is a fascinating and lucrative strategy for those equipped with the right tools, knowledge, and resources. While opportunities for arbitrage have diminished in today’s tech-driven markets, it remains an essential mechanism for ensuring market efficiency and liquidity.

For individual investors, arbitrage might not be a viable strategy due to its high barriers to entry. However, understanding its principles can enhance your financial acumen and potentially inform your broader investment strategies.

Interested in exploring more about financial strategies? Dive deeper into alternative investments and discover how you can unlock new avenues of wealth.